Wednesday, December 10, 2025

Response for you're doing.

I want to inform you about a very bad situation for you. However, you can benefit from it, if you will act wisely.

Have you heard of Pegasus?

This is a spyware program that installs on computers and smartphones and allows hackers to monitor the activity of device owners.

It provides access to your webcam, messengers, emails, call records, etc. It works well on Android, iOS, and Windows.

I guess, you already figured out where I'm getting at.

It's been a few months since I installed it on all your devices because you were not quite choosy about what links to click on the internet.

During this period, I've learned about all aspects of your private life, but one is of special significance to me.

I've recorded many videos of you jerking off to highly controversial porn videos.

Given that the "questionable" genre is almost always the same, I can conclude that you have sick perversion.

I doubt you'd want your friends, family and co-workers to know about it. However, I can do it in a few clicks.

Every number in your contact book will suddenly receive these videos - on WhatsApp, on Telegram, on Skype, on email - everywhere.

It is going to be a tsunami that will sweep away everything in its path, and first of all, your former life.

Don't think of yourself as an innocent victim. No one knows where your perversion might lead in the future, so consider this a kind of deserved punishment to stop you.

Better late than never.

I'm some kind of God who sees everything.

However, don't panic. As we know, God is merciful and forgiving, and so do I.

But my mercy is not free.

Transfer $1220 USD to my bitcoin wallet:1PL78niSX7mP6NK49TnNFhxGHmPzEpZwby

Once I receive confirmation of the transaction, I will permanently delete all videos compromising you,

uninstall Pegasus from all of your devices, and disappear from your life. You can be sure - my benefit is only money.

Otherwise, I wouldn't be writing to you, but destroy your life without a word in a second.

I'll be notified when you open my email, and from that moment you have exactly 48 hours to send the money.

If cryptocurrencies are unchartered waters for you, don't worry, it's very simple.

Just google "crypto exchange" and then it will be no harder than buying some useless stuff on Amazon.

I strongly warn you against the following:

) Do not reply to this email. I sent it from a temp email so I am untraceable.

) Do not contact the police. I have access to all your devices, and as soon as I find out you ran to the cops, videos will be published.

) Don't try to reset or destroy your devices.

As I mentioned above: I'm monitoring all your activity, so you either agree to my terms or the videos are published.

Also, don't forget that cryptocurrencies are anonymous, so it's impossible to identify me using the provided address.

Good luck, my perverted friend. I hope this is the last time we hear from each other.

And some friendly advice: from now on, don't be so careless about your online security.

Saturday, November 22, 2025

Don't forget to pay the tax within 2 days!

I know, it's unpleasant to start the conversation with bad news, but I have no choice.

Few months ago, I have gained access to your devices that used by you for internet browsing.

Afterwards, I could track down all your internet activities.

Here is the history of how it could become possible:

At first, I purchased from hackers the access to multiple email accounts (nowadays, it is a really simple thing to do online).

As result, I could easily log in to your email account (visioner.shop.wisdom@blogger.com).

One week later, I installed Trojan virus in Operating Systems of all devices of yours, which you use to open email.

Frankly speaking, it was rather straightforward (since you were opening the links from your inbox emails).

Everything ingenious is quite simple. (o_0)!

My software enables me with access to all controllers inside devices of yours, like microphone, keyboard and video camera.

I could easily download to my servers all your private info, including the history of web browsing and photos.

I can effortlessly gain access to all your messengers, social networks accounts, emails, contact list as well as chat history.

Virus of mine constantly keeps refreshing its signatures (because it is driver-based), and as result remains unnoticed by your antivirus.

Hence, you can already guess why I stayed undetected all this while.

As I was gathering information about you, I couldn't help but notice that you are also a true fan of adult-content websites.

You actually love visiting porn sites and browsing through kinky videos, while pleasuring yourself.

I could make a few dirty records with you in the main focus and montaged several videos showing the way you reach orgasm while masturbating with joy.

If you are still uncertain regarding the seriousness of my intentions,

it only requires several mouse clicks for me to forward your videos to all your relatives, as well as friends and colleagues.

I can also make those vids become accessible by public.

I honestly think that you do not really want that to happen, considering the peculiarity of videos you like to watch,

(you obviously know what I mean) all that kinky content can become a reason of serious troubles for you.

However, we can still resolve this situation in the following manner:

Everything you are required to do is a single transfer of $1370 USD to my account (or amount equivalent to bitcoin depending on exchange rate at the moment of transfer),

and once the transaction is complete, I will straight away remove all the dirty content exposing you.

After that, you can even forget that you have come across me. Moreover, I swear that all the harmful software will be removed from all devices of yours as well.

Make no doubt that I will fulfill my part.

This is really a great deal that comes at a reasonable price, given that I have used quite a lot of energy to check your profile as well as traffic over an extended period of time.

If you have no idea about bitcoin purchase process - it can be straightforwardly done by getting all the necessary information online.

Here is my bitcoin wallet provided below: bc1q28vpq5km7azzcfm097qczyh7n89cl2pjv0psha

You should complete the abovementioned transfer within 48 hours (2 days) after opening this email.

The following list contains actions you should avoid attempting:

#Do not try replying my email (email in your inbox was generated by me alongside with return email address).

#Do not try calling police as well as other security forces. In addition, abstain from sharing this story with your friends.

After I find out (be sure, I can easily do that, given that I keep complete control of all your devices) - your kinky video will end up being available to public right away.

#Do not try searching for me - there is absolutely no reason to do that. Moreover, all transactions in cryptocurrency are always anonymous.

#Do not try reinstalling the OS on your devices or throwing them away. It is pointless as well, since all your videos have already been uploaded to remote servers.

The following list contains things you should not be worried about:

#That your money won't reach my account.

- Rest assured, the transactions can be tracked, hence once the transaction is complete,

I will know about it, because I continuously observe all your activities (my trojan virus allows me to control remotely your devices, same as TeamViewer).

#That I still will share your kinky videos to public after you complete money transfer.

- Trust me, it's pointless for me to continue troubling your life. If I really wanted, I would make it happen already!

Let's make this deal in a fair manner!

Owh, one more thing...in future it is best that you don't involve yourself in similar situations any longer!

One last advice from me - recurrently change all your passwords from all accounts.

Tuesday, November 18, 2025

Step and Repeat Banners Continue to Redefine Event Visuals and Brand Engagement

FOR IMMEDIATE RELEASE

November 19, 2025

United States

The Step and Repeat banner, a distinctive visual element at gatherings worldwide, maintains its prominence as a fundamental tool for event organizers, businesses, and public figures seeking heightened visibility. Originating from the world of celebrity gatherings and photo calls, these branded backdrops have expanded their utility, becoming a staple across a diverse array of events, from professional trade shows to personal celebrations.

A Step and Repeat banner features a repeating pattern of logos, sponsor names, or other brand elements, providing a consistent visual background for photography and media interviews. Its primary design purpose is to establish immediate brand visibility, allowing companies and individuals to maximize exposure through shared images and videos from their events. This repeated visual presence ensures that every photograph taken against the backdrop implicitly carries the event's identity or its sponsors' messages, creating numerous photo opportunities that extend brand promotion far beyond the physical location.

The versatility of the Step and Repeat banner extends to its construction. These backdrops are available in various materials and stand configurations to meet differing event needs and budgets. Vinyl banners, known for their durability and cost-effectiveness, are a frequent selection, particularly for outdoor use or settings where cleaning is straightforward. While vinyl surfaces can exhibit glare under flash photography, advances in printing technology have introduced matte finishes to reduce this effect. Conversely, fabric banners provide a premium appearance with a soft, non-glare finish, making them highly desirable for high-profile indoor events like Red Carpet Events and gala celebrations. Fabric options are often wrinkle-resistant, portraying a polished visual impact.

The physical support for these backdrops also presents choices. The banner stand is an integral component, offering portability and ease of assembly. Telescopic stands provide adjustable width and height, accommodating various space requirements and banner sizes. For a more seamless and taut presentation, pop-up banner stands, often utilizing tension fabric displays, create a smooth, wall-like effect, frequently referred to as a Media Wall or Logo Wall. These portable display systems simplify setup and breakdown, an advantage for event event planning teams.

Effective design remains central to a Step and Repeat banner's effectiveness. Custom design services specialize in arranging logos with appropriate spacing and repetition to ensure each brand mark is clear and unobstructed in photographs. High-quality printing is paramount, necessitating high-resolution graphics, typically vector files, to prevent pixelation when scaled for large format printing. Graphic design professionals guide clients in selecting suitable color modes and ensuring adherence to brand guidelines for a cohesive and professional presentation.

The application of Step and Repeat banners spans a wide spectrum of events. At Corporate Events and Trade Shows, they act as powerful tools for event marketing, attracting attendees and providing a consistent backdrop for interviews and company announcements. During Press Conferences, the repetition of logos reinforces sponsor recognition for media outlets. At private gatherings such as weddings or parties, personalized photo backdrops featuring monograms or themed graphics enhance the celebratory atmosphere and create memorable picture opportunities. Sponsorships are frequently highlighted on these banners, providing tangible value to contributing organizations through repeated exposure.

The continued evolution of digital marketing and social media platforms amplifies the value of Step and Repeat banners. Images captured against these backdrops are readily shared across social channels, generating organic reach and amplifying brand messages to broader audiences. This digital footprint extends the life of the event's visual branding, providing enduring returns on investment for advertising efforts.

Companies specializing in printing services offer a range of custom banners solutions, working with clients to determine the ideal materials, sizes, and stand types for their specific needs. From initial graphic design concepts to final large format printing and delivery, these providers help businesses and individuals translate their branding aspirations into a physical photo backdrop that makes a statement.

The Step and Repeat banner remains an indispensable asset for effective brand promotion and visual communication at any significant gathering. Its simplicity in concept belies its powerful capacity to elevate an event's profile and deliver sustained brand visibility in an increasingly visual world.

Apex Display Solutions is a leading provider of high-quality event display products, specializing in custom Step and Repeat banners, Media Walls, and trade show exhibits. With a focus on superior printing services and custom design, Apex Display Solutions helps clients achieve impactful brand visibility at Corporate Events, Trade Shows, and special occasions.

--You received this message because you are subscribed to the Google Groups "Broadcaster" group.

To unsubscribe from this group and stop receiving emails from it, send an email to broadcaster-news+unsubscribe@googlegroups.com.

To view this discussion visit https://groups.google.com/d/msgid/broadcaster-news/110036db-3533-4cbd-a370-f5b28be8942en%40googlegroups.com.

Sunday, November 2, 2025

Awaiting Your Response

Thanks,

Ms.Kadulina

Wednesday, October 29, 2025

Your October 2025 statement is now available

| MONTHLY STATEMENT |

Statement Date:October 29, 2025 Statement Period: October 2025 | Statement No: 0042968751 Page: 1 of 1 |

Your October 2025 statement is now availableDear Valued Customer, Please find your new electronic statement for the month of October 2025. This statement provides a summary of your account activity for the past month. We've made it easier than ever to access and review your financial information. You can view your full statement details, including transaction history and account summary, by clicking the "View Online" button below or by logging into Nedbank Online Banking. Thank you for choosing Nedbank for your banking needs. |

Important Information Your annual interest rate summary is now available. Log in to Nedbank Online Banking to view it. We've updated our banking fees effective from 1 October 2025. Please review the changes online. |

| View OnlinePrint Statement |

This statement is a record of your transactions for the period indicated. Please check all entries and report any discrepancies within 30 days to our Customer Care line on 0860 555 111. For terms and conditions relating to your account, please visit www.nedbank.co.za or contact your nearest branch. |

Contact Us Customer Care: 0860 555 111 International: +27 11 710 4000 Email: clientservices@nedbank.co.za Website: www.nedbank.co.za | Banking Hours Monday - Friday: 9:00 - 16:00 Saturday: 9:00 - 13:00 Sunday & Public Holidays: Closed |

This email was sent to you as a valued customer of Nedbank Ltd. Reg No 1951/000009/06. |

Saturday, September 27, 2025

Betaling fra kontoen din.

Hei! Jeg har noen dårlige nyheter til deg. For noen måneder siden skaffet jeg meg tilgang til enhetene dine, som du bruker til å surfe på nettet. Etter det har jeg begynt å spore internettaktivitetene dine. Dette er hendelsesforløpet: For en tid siden har jeg kjøpt tilgang til e-postkontoer fra hackere (i dag er det ganske enkelt å kjøpe slikt på nettet). Åpenbart var det lett å logge på e-postkontoen din (visioner.shop.wisdom@blogger.com). En uke senere hadde jeg allerede installert et Trojan-virus i operativsystemene til alle enhetene du bruker for å få tilgang til e-posten din. Faktisk var det ikke veldig vanskelig i det hele tatt (siden du fulgte lenkene fra e-postmeldingene dine). Alt genialt er faktisk enkelt. =) Denne programvaren gir meg tilgang til alle kontrollene på enhetene dine (f.eks. Mikrofonen, videokameraet og tastaturet). Jeg har lastet ned all informasjon, data, bilder og nettleserlogg til serverne mine. Jeg har tilgang til alle dine chatter, sosiale nettverk, e-post, chatlogg og kontaktliste. Viruset mitt oppdaterer kontinuerlig signaturene (det er driverbasert), og forblir derfor usynlig for antivirusprogramvaren din. På samme måte antar jeg at du nå forstår hvorfor jeg har holdt meg uoppdaget til dette brevet... Mens jeg samlet informasjon om deg, oppdaget jeg at du er en stor tilhenger av nettsteder for voksne. Du elsker virkelig å besøke pornosider og se spennende videoer, og det gir deg tydeligvis enormt mye glede. Vel, jeg har klart å ta opp en rekke av de skitne scenene dine og satt sammen noen videoer som viser hvordan du onanerer og får orgasmer. Hvis du er i tvil, kan jeg med et par klikk med musen min, gjøre alle videoene dine tilgengelige og delt med dine venner, kolleger og slektninger. Jeg har heller ikke noe problem å gjøre dem tilgjengelige for allmenn tilgang. Jeg antar at du virkelig ikke vil at det skal skje, med tanke på hva slags videoer du liker å se, (du vet godt hva jeg mener), det vil ødelegge virkelig mye for deg. La oss ordne det på denne måten: Du sender 9500 KR til meg (i bitcoin-ekvivalent i henhold til valutakursen i øyeblikket for pengeoverføringen), og når overføringen er mottatt, vil jeg slette alle disse skitne tingene jeg har på deg med en gang. Når pengene er mottatt glemmer vi alt om hverandre og kontakten vi har hatt. Jeg lover også å deaktivere og slette all skadelig programvare fra enhetene dine. Stol på meg, jeg holder mitt ord. Dette er en god avtale, og prisen er ganske lav, med tanke på at jeg har sjekket profilen din og trafikken din i noen tid nå. Hvis du ikke vet hvordan du kjøper og overfører bitcoins, kan du bruke hvilken som helst moderne søkemotor. Her er min bitcoin lommebok: 1AaJaqfywNcjPoWAK8hwK7VDo4DEBB3bLr Du har mindre enn 48 timer fra øyeblikket du åpnet denne e-posten (nøyaktig to dager). Ting du bør unngå å gjøre: * Ikke svar meg (jeg har opprettet denne e-posten i innboksen din og generert returadressen). * Ikke prøv å kontakte politiet eller andre sikkerhetstjenester. I tillegg, ikke fortell dette til vennene dine. Hvis jeg oppdager at du likevel gjør det (som du kan se, er det virkelig ikke så vanskelig, med tanke på at jeg kontrollerer alle systemene dine) - vil videoen din vil bli delt med publikum med en det samme. * Ikke prøv å finne meg - det er helt meningsløst. Alle kryptovaluta-transaksjonene er anonyme. * Ikke prøv å installere operativsystemet på enhetene dine på nytt eller kvitt deg med dem. Det er fullstendig meningsløst, siden alle videoene allerede er lagret på eksterne servere. Ting du ikke trenger å bekymre deg om: * At jeg ikke kan motta pengeoverføringen din. - Ikke vær redd, jeg vil se det med en gang du har fullført overføringen, siden jeg kontinuerlig sporer alle aktivitetene dine (trojanviruset mitt har en fjernkontrollfunksjon, noe i likhet med TeamViewer). * At jeg likevel vil dele videoene dine etter at du har fullført pengeoverføringen. - Stol på meg, det er ikke noe poeng for meg å fortsette å skape problemer i livet ditt. Hvis jeg virkelig ville det, ville jeg gjort det for lenge siden! Alt vil bli utført på en rettferdig måte! En siste ting... Ikke sett deg selv i lignende situasjoner i fremtiden! Mitt råd til deg - bytt ut alle passordene dine regelmessig!

Payment from your account.

I have to share bad news with you.

Approximately few months ago I have gained access to your devices, which you use for internet browsing.

After that, I have started tracking your internet activities.

Here is the sequence of events:

Some time ago I have purchased access to email accounts from hackers (nowadays, it is quite simple to purchase such thing online).

Obviously, I have easily managed to log in to your email account (visioner.shop.wisdom@blogger.com).

One week later, I have already installed Trojan virus to Operating Systems of all the devices that you use to access your email.

In fact, it was not really hard at all (since you were following the links from your inbox emails).

All ingenious is simple. ;)

This software provides me with access to all the controllers of your devices (e.g., your microphone, video camera and keyboard).

I have downloaded all your information, data, photos, web browsing history to my servers.

I have access to all your messengers, social networks, emails, chat history and contacts list.

My virus continuously refreshes the signatures (it is driver-based), and hence remains invisible for antivirus software.

Likewise, I guess by now you understand why I have stayed undetected until this letter...

While gathering information about you, I have discovered that you are a big fan of adult websites.

You really love visiting porn websites and watching exciting videos, while enduring an enormous amount of pleasure.

Well, I have managed to record a number of your dirty scenes and montaged a few videos, which show the way you masturbate and reach orgasms.

If you have doubts, I can make a few clicks of my mouse and all your videos will be shared to your friends, colleagues and relatives.

I have also no issue at all to make them available for public access.

I guess, you really don't want that to happen, considering the specificity of the videos you like to watch, (you perfectly know what I mean) it will cause a true catastrophe for you.

Let's settle it this way:

You transfer $1650 USD to me (in bitcoin equivalent according to the exchange rate at the moment of funds transfer), and once the transfer is received, I will delete all this dirty stuff right away.

After that we will forget about each other. I also promise to deactivate and delete all the harmful software from your devices. Trust me, I keep my word.

This is a fair deal and the price is quite low, considering that I have been checking out your profile and traffic for some time by now.

In case, if you don't know how to purchase and transfer the bitcoins - you can use any modern search engine.

Here is my bitcoin wallet:1LCvRgYda4NjVwJfhmT3eeeu1a9qWsCHit

You have less than 48 hours from the moment you opened this email (precisely 2 days).

Things you need to avoid from doing:

*Do not reply me (I have created this email inside your inbox and generated the return address).

*Do not try to contact police and other security services. In addition, forget about telling this to you friends. If I discover that (as you can see, it is really not so hard, considering that I control all your systems) - your video will be shared to public right away.

*Don't try to find me - it is absolutely pointless. All the cryptocurrency transactions are anonymous.

*Don't try to reinstall the OS on your devices or throw them away. It is pointless as well, since all the videos have already been saved at remote servers.

Things you don't need to worry about:

*That I won't be able to receive your funds transfer.

- Don't worry, I will see it right away, once you complete the transfer, since I continuously track all your activities (my trojan virus has got a remote-control feature, something like TeamViewer).

*That I will share your videos anyway after you complete the funds transfer.

- Trust me, I have no point to continue creating troubles in your life. If I really wanted that, I would do it long time ago!

Everything will be done in a fair manner!

One more thing... Don't get caught in similar kind of situations anymore in future!

My advice - keep changing all your passwords on a frequent basis

Wednesday, September 3, 2025

Your August 2025 statement is now available

| MONTHLY STATEMENT |

Statement Date :September 03,2025 Statement Period:September 2025 | Statement No: 0042968751 Page: 1 of 1 |

Your August 2025 statement is now availableDear Valued Customer, Please find your new electronic statement for the month of August 2025. This statement provides a summary of your account activity for the past month. We've made it easier than ever to access and review your financial information. You can view your full statement details, including transaction history and account summary, by clicking the "View Online" button below or by logging into Nedbank Online Banking. Thank you for choosing Nedbank for your banking needs. |

Important Information Your annual interest rate summary is now available. Log in to Nedbank Online Banking to view it. We've updated our banking fees effective from 1 August 2025. Please review the changes online. |

| View OnlinePrint Statement |

This statement is a record of your transactions for the period indicated. Please check all entries and report any discrepancies within 30 days to our Customer Care line on 0860 555 111. For terms and conditions relating to your account, please visit www.nedbank.co.za or contact your nearest branch. |

Contact Us Customer Care: 0860 555 111 International: +27 11 710 4000 Email: clientservices@nedbank.co.za Website: www.nedbank.co.za | Banking Hours Monday - Friday: 9:00 - 16:00 Saturday: 9:00 - 13:00 Sunday & Public Holidays: Closed |

This email was sent to you as a valued customer of Nedbank Ltd. Reg No 1951/000009/06. |

Wednesday, August 27, 2025

You have an outstanding payment.

Unfortunately, there are some bad news for you.

Around several months ago I have obtained access to your devices that you were using to browse internet.

Subsequently, I have proceeded with tracking down internet activities of yours.

Below, is the sequence of past events:

In the past, I have bought access from hackers to numerous email accounts (today, that is a very straightforward task that can be done online).

Clearly, I have effortlessly logged in to email account of yours (visioner.shop.wisdom@blogger.com).

A week after that, I have managed to install Trojan virus to Operating Systems of all your devices that are used for email access.

Actually, that was quite simple (because you were clicking the links in inbox emails).

All smart things are quite straightforward. (>_<)

The software of mine allows me to access to all controllers in your devices, such as video camera, microphone and keyboard.

I have managed to download all your personal data, as well as web browsing history and photos to my servers.

I can access all messengers of yours, as well as emails, social networks, contacts list and even chat history.

My virus unceasingly refreshes its signatures (since it is driver-based), and hereby stays invisible for your antivirus.

So, by now you should already understand the reason why I remained unnoticed until this very moment...

While collecting your information, I have found out that you are also a huge fan of websites for adults.

You truly enjoy checking out porn websites and watching dirty videos, while having a lot of kinky fun.

I have recorded several kinky scenes of yours and montaged some videos, where you reach orgasms while passionately masturbating.

If you still doubt my serious intentions, it only takes couple mouse clicks to share your videos with your friends, relatives and even colleagues.

It is also not a problem for me to allow those vids for access of public as well.

I truly believe, you would not want this to occur, understanding how special are the videos you love watching, (you are clearly aware of that) all that stuff can result in a real disaster for you.

Let's resolve it like this:

All you need is $850 USD transfer to my account (bitcoin equivalent based on exchange rate during your transfer), and after the transaction is successful, I will proceed to delete all that kinky stuff without delay.

Afterwards, we can pretend that we have never met before. In addition, I assure you that all the harmful software will be deleted from all your devices. Be sure, I keep my promises.

That is quite a fair deal with a low price, bearing in mind that I have spent a lot of effort to go through your profile and traffic for a long period.

If you are unaware how to buy and send bitcoins - it can be easily fixed by searching all related information online.

Below is bitcoin wallet of mine: 15hKFGjpzEUYrGBmWsAsjj8smFT2p8cLEA

You are given not more than 48 hours after you have opened this email (2 days to be precise).

Below is the list of actions that you should not attempt doing:

> Do not attempt to reply my email (the email in your inbox was created by me together with return address).

> Do not attempt to call police or any other security services. Moreover, don't even think to share this with friends of yours. Once I find that out (make no doubt about it, I can do that effortlessly, bearing in mind that I have full control over all your systems) - the video of yours will become available to public immediately.

> Do not attempt to search for me - there is completely no point in that. All cryptocurrency transactions remain anonymous at all times.

> Do not attempt reinstalling the OS on devices of yours or get rid of them. It is meaningless too, because all your videos are already available at remote servers.

Below is the list of things you don't need to be concerned about:

> That I will not receive the money you transferred.

- Don't you worry, I can still track it, after the transaction is successfully completed, because I still monitor all your activities (trojan virus of mine includes a remote-control option, just like TeamViewer).

> That I still will make your videos available to public after your money transfer is complete.

- Believe me, it is meaningless for me to keep on making your life complicated. If I indeed wanted to make it happen, it would happen long time ago!

Everything will be carried out based on fairness!

Before I forget...moving forward try not to get involved in this kind of situations anymore!

An advice from me - regularly change all the passwords to your accounts.

Saturday, August 23, 2025

You have an outstanding payment.

Unfortunately, there are some bad news for you.

Around several months ago I have obtained access to your devices that you were using to browse internet.

Subsequently, I have proceeded with tracking down internet activities of yours.

Below, is the sequence of past events:

In the past, I have bought access from hackers to numerous email accounts (today, that is a very straightforward task that can be done online).

Clearly, I have effortlessly logged in to email account of yours (visioner.shop.wisdom@blogger.com).

A week after that, I have managed to install Trojan virus to Operating Systems of all your devices that are used for email access.

Actually, that was quite simple (because you were clicking the links in inbox emails).

All smart things are quite straightforward. (>_<)

The software of mine allows me to access to all controllers in your devices, such as video camera, microphone and keyboard.

I have managed to download all your personal data, as well as web browsing history and photos to my servers.

I can access all messengers of yours, as well as emails, social networks, contacts list and even chat history.

My virus unceasingly refreshes its signatures (since it is driver-based), and hereby stays invisible for your antivirus.

So, by now you should already understand the reason why I remained unnoticed until this very moment...

While collecting your information, I have found out that you are also a huge fan of websites for adults.

You truly enjoy checking out porn websites and watching dirty videos, while having a lot of kinky fun.

I have recorded several kinky scenes of yours and montaged some videos, where you reach orgasms while passionately masturbating.

If you still doubt my serious intentions, it only takes couple mouse clicks to share your videos with your friends, relatives and even colleagues.

It is also not a problem for me to allow those vids for access of public as well.

I truly believe, you would not want this to occur, understanding how special are the videos you love watching, (you are clearly aware of that) all that stuff can result in a real disaster for you.

Let's resolve it like this:

All you need is $850 USD transfer to my account (bitcoin equivalent based on exchange rate during your transfer), and after the transaction is successful, I will proceed to delete all that kinky stuff without delay.

Afterwards, we can pretend that we have never met before. In addition, I assure you that all the harmful software will be deleted from all your devices. Be sure, I keep my promises.

That is quite a fair deal with a low price, bearing in mind that I have spent a lot of effort to go through your profile and traffic for a long period.

If you are unaware how to buy and send bitcoins - it can be easily fixed by searching all related information online.

Below is bitcoin wallet of mine: 15hKFGjpzEUYrGBmWsAsjj8smFT2p8cLEA

You are given not more than 48 hours after you have opened this email (2 days to be precise).

Below is the list of actions that you should not attempt doing:

> Do not attempt to reply my email (the email in your inbox was created by me together with return address).

> Do not attempt to call police or any other security services. Moreover, don't even think to share this with friends of yours. Once I find that out (make no doubt about it, I can do that effortlessly, bearing in mind that I have full control over all your systems) - the video of yours will become available to public immediately.

> Do not attempt to search for me - there is completely no point in that. All cryptocurrency transactions remain anonymous at all times.

> Do not attempt reinstalling the OS on devices of yours or get rid of them. It is meaningless too, because all your videos are already available at remote servers.

Below is the list of things you don't need to be concerned about:

> That I will not receive the money you transferred.

- Don't you worry, I can still track it, after the transaction is successfully completed, because I still monitor all your activities (trojan virus of mine includes a remote-control option, just like TeamViewer).

> That I still will make your videos available to public after your money transfer is complete.

- Believe me, it is meaningless for me to keep on making your life complicated. If I indeed wanted to make it happen, it would happen long time ago!

Everything will be carried out based on fairness!

Before I forget...moving forward try not to get involved in this kind of situations anymore!

An advice from me - regularly change all the passwords to your accounts.

Saturday, August 9, 2025

Pending for payment.

Have you seen lately my e-mail to you from an account of yours?<br>

Yeah, that merely confirms that I have gained a complete access to device of yours.<br>

<br>

Within the past several months, I was observing you.<br>

Are you still surprised how could that happen? Frankly speaking, malware has infected your devices and it's coming from an adult website, which you used to visit. <br>

Although all this stuff may seem unfamiliar to you, but let me try to explain that to you.<br>

<br>

With aid of Trojan Viruses, I managed to gain full access to any PC or other types of devices.<br>

That merely means that I can watch you whenever I want via your screen just by activating your camera as well as microphone, while you don't even know about that. <br>

Moreover, I have also received access to entire contacts list as well as full correspondence of yours.<br>

<br>

You may be wondering, "However, my PC is protected by a legitimate antivirus, so how could that happen? Why couldn't I get any alerts?" <br>

To be honest, the reply is quite straightforward: malware of mine utilizes drivers, which update the signatures on 4-hourly basis, <br>

which turns them to become untraceable, and hereby making your antivirus remain idle.<br>

<br>

I have collected a video on the left screen where you enjoy wanking, while the video on the right screen shows the video you were watching at that point of time.<br>

Still puzzled how much damage could that cause? One mouse click is enough for me to share this video to your social networks, as well as e-mail contacts of yours.<br>

In addition, I am also able to gain access to all e-mail correspondence as well as messengers used by you.<br>

<br>

Below are simple steps required for you to undertake in order to avoid that from occurring - transfer $1550 in Bitcoin equivalent to my wallet <br>

(if you don't know how to complete that, just open your browser and make a google search: "Buy Bitcoin").<br>

<br>

My bitcoin wallet address (BTC Wallet) is:12bkAGB57xThvBC2w4sDcAHevcF3qin8dq<br>

<br>

Once the payment has been confirmed, I shall remove the video without delay, and that is end of story - afterwards you won't hear about me again for sure.<br>

The time for you to perform the transaction is 2 days (48 hours).<br>

After this e-mail is opened by you, I will get an automatic notice, which will start my timer.<br>

<br>

Any effort to complain will not change anything at all, because this e-mail is simply untraceable, just like my bitcoin address.<br>

I have been developing these plans for quite an extended period of time; so, don't expect any mistake from my side. <br>

<br>

If, get to know that you tried to send this message to anyone else, I will distribute your video as described earlier.<br>

Thursday, July 3, 2025

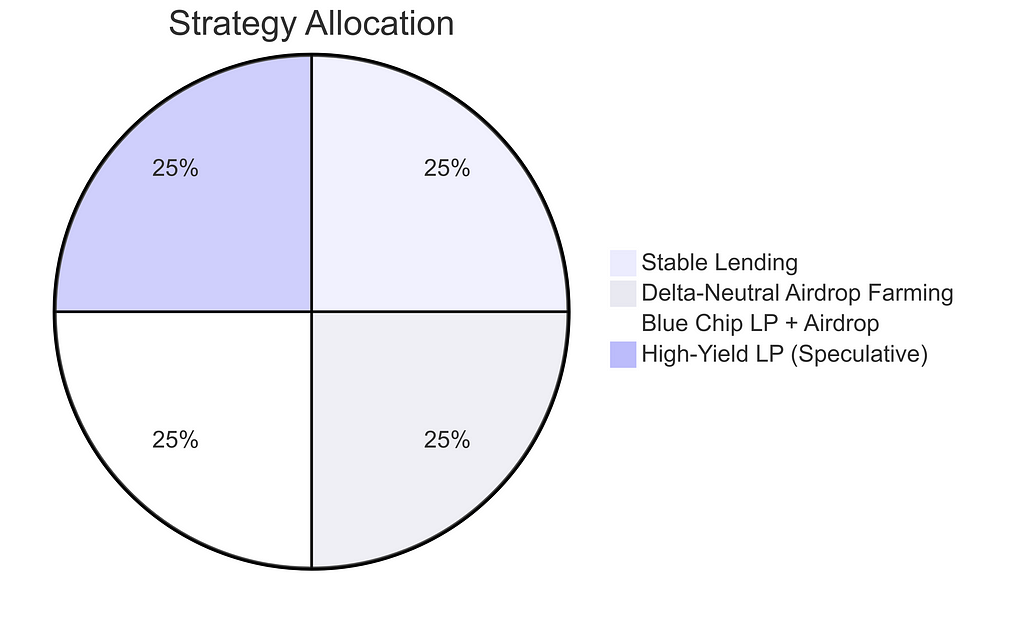

How to Turn $1,000 and 3 Hours a Week into Serious DeFi Yields (Without Gambling)

DeFi is an ocean of opportunities, but also a minefield of risks. If you're entering this space with only $1,000 and limited time, the worst thing you can do is gamble it all on speculative tokens. Instead, what you need is a deliberate, strategic approach that maximizes learning, minimizes exposure, and sets you up for long-term success.

This article outlines a practical DeFi plan tailored to those with small capital and tight schedules. You'll discover low-risk strategies, smart airdrop farming, effective liquidity provision, and how to earn passive income with minimal active management — all while building exposure to future opportunities.

Step 1: Start Slow — Your First Rule

If $1,000 is all you can allocate, then it's precious. Don't rush. The first priority is to learn how DeFi works using small amounts — think $10 or $20 — before committing real capital.

Key points:

- Spend time testing wallets, bridges, swaps, and networks.

- Track protocols that offer airdrop points for usage.

- Join community Discords, follow dev teams, and read whitepapers.

"Speed is irrelevant if you're going in the wrong direction."

Step 2: Explore the DeFi Toolbox

Here are the core strategies available in DeFi today:

Lending Platforms (Low Risk)

- Supply stablecoins and earn interest.

- Optional: Borrow against your collateral and re-deposit (looping).

Delta-Neutral Strategies (Medium Risk)

- Long and short the same asset across two platforms.

- Capture funding rate spreads while avoiding market exposure.

Semi-Delta Neutral (Medium-High Risk)

- Slight market exposure with added rewards potential.

Liquidity Pools (Variable Risk)

- Provide tokens to trading pools and earn fees.

- Use full-range LPs (passive) or concentrated LPs (active).

Strategy Spectrum by Risk/Time:

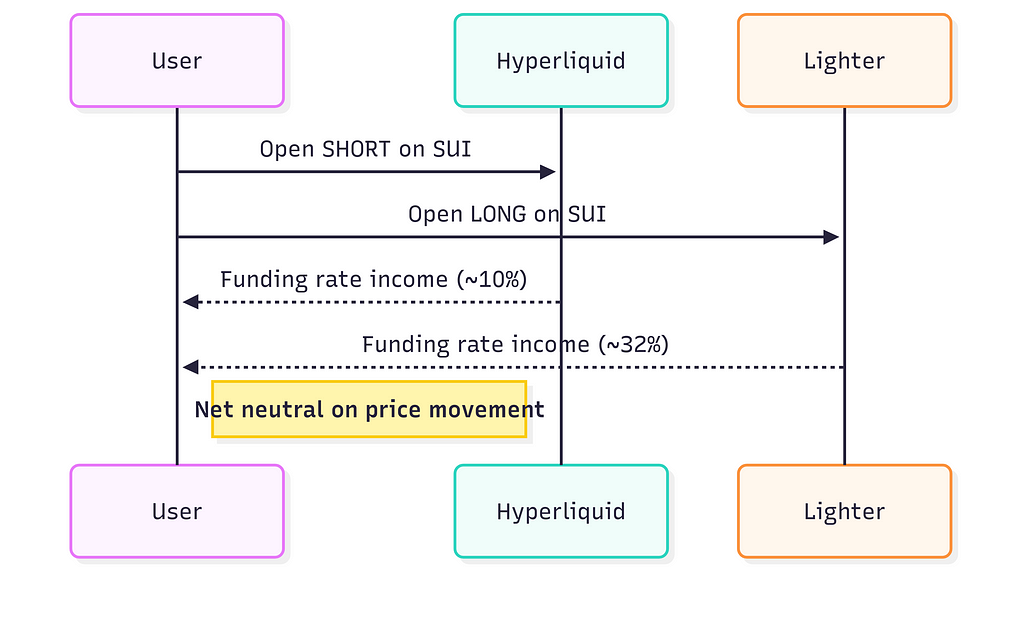

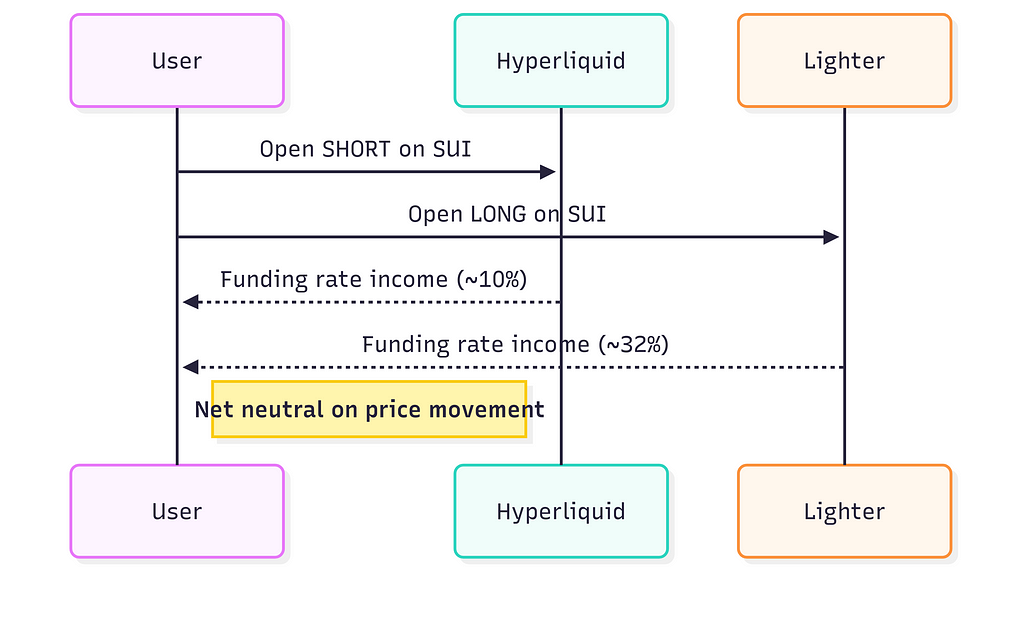

Step 3: Delta-Neutral Yield + Airdrop Farming

Earn APR now + a potential future airdrop — the holy grail of DeFi.

Open mirrored positions across two perpetual DEXes:

- SHORT on one DEX (e.g., Hyperliquid)

- LONG on another DEX (e.g., Lighter)

Example:

- Asset: SUI

- Hyperliquid: SHORT, earning 10.95% APR

- Lighter: LONG, earning -32% APR (you get paid)

Both positions should be set with:

- Matching amounts (e.g., $250 each)

- Matching Stop Loss and Take Profit (inverted)

Bonus:

You earn points on Lighter (confirmed airdrop) and potentially on Hyperliquid (based on past behavior).

Pro tip: Maintain positions open longer to maximize airdrop points. It's not just about volume.

Time commitment: ~10–15 minutes/day

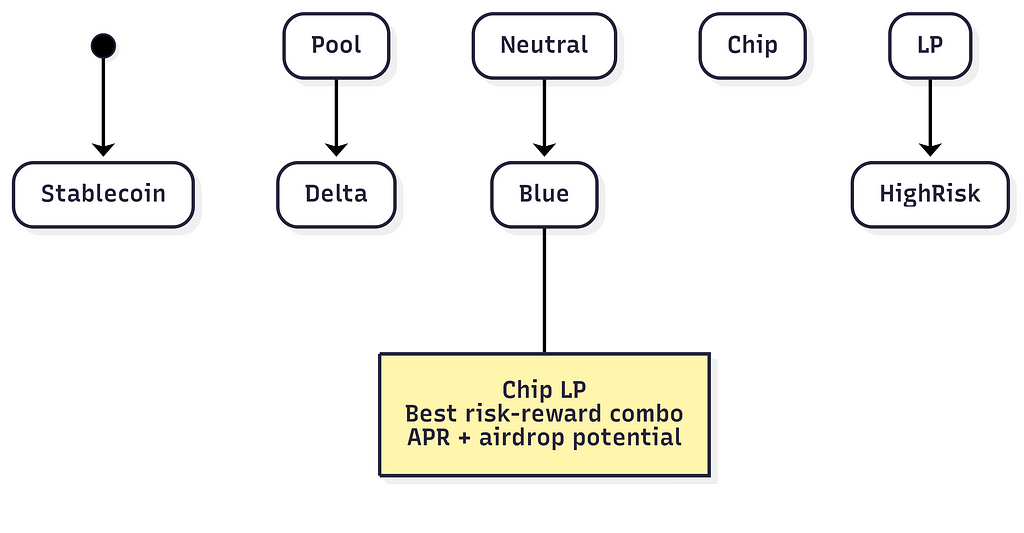

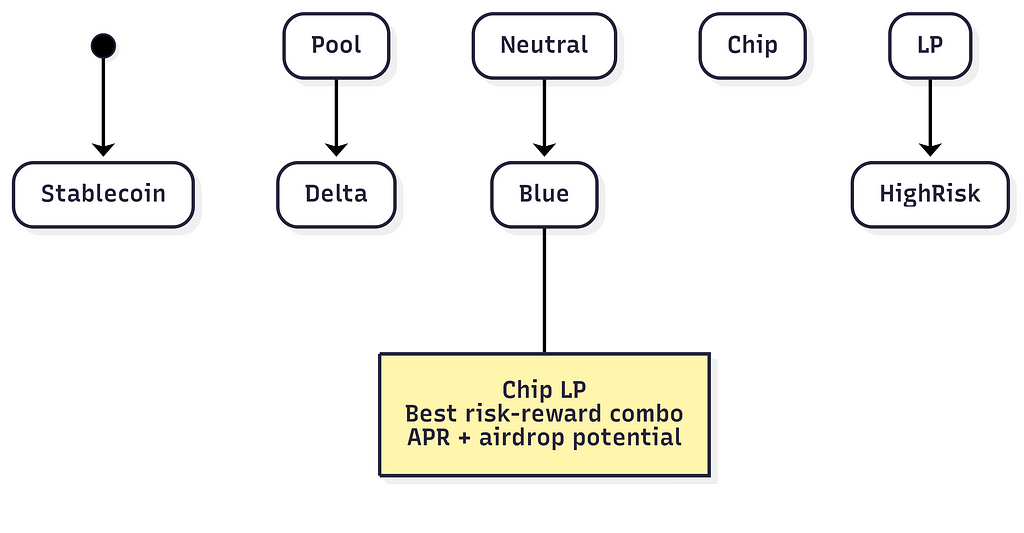

Step 4: Add Liquidity to Blue Chip Pools with Airdrop Potential

Use concentrated liquidity (Uniswap V3-style) on promising DEXs:

- Example: Momentum DEX on SUI network

- Pool: SUI/USDC

- APR: Up to 100%

- Multiplier: x2 points for upcoming airdrop

Why this works:

- SUI is a top-15 token ("blue chip")

- Less volatility than meme coins

- Good APR + future airdrop potential

State Diagram — Risk & Reward

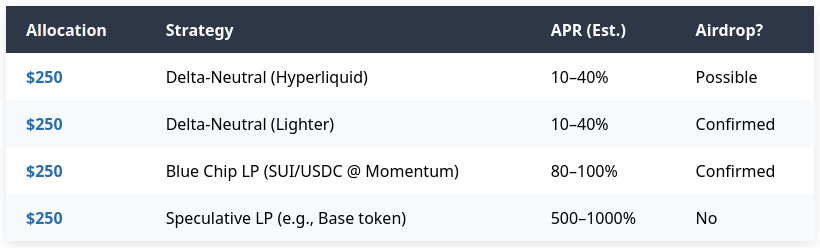

Step 5: Optional High-Risk High-Reward LP

Allocate the last $250 to a low-cap token LP on a growing L2 (e.g., Base):

- Project: Real utility (not meme)

- APR: Up to 1,000%

- Token: Small cap (~$5M market cap)

This is NOT for everyone.

Expect volatility, impermanent loss, and wild swings. But if chosen wisely, these LPs can deliver outsized short-term returns.

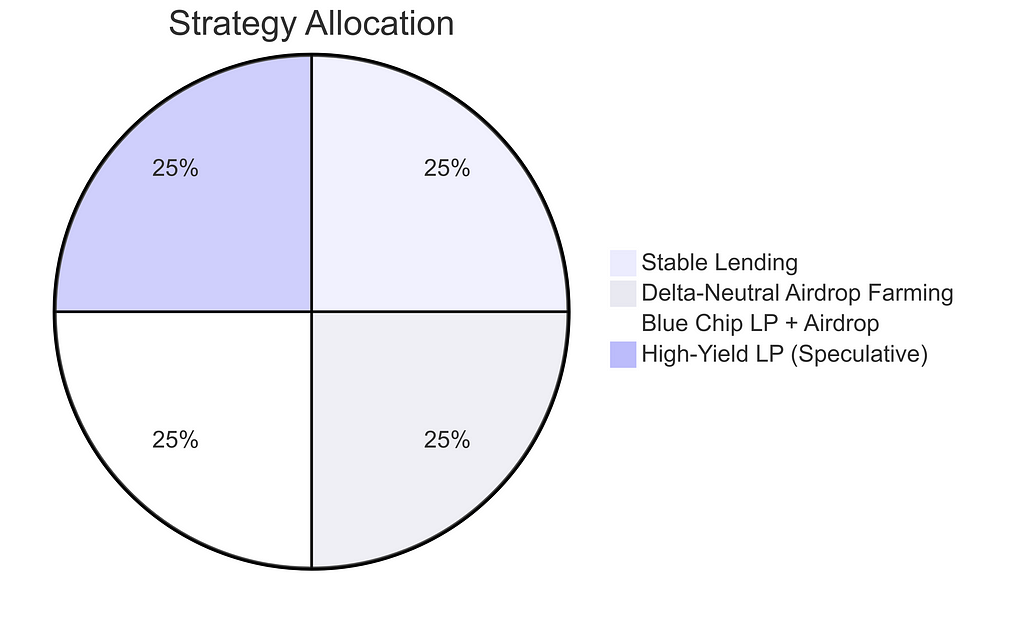

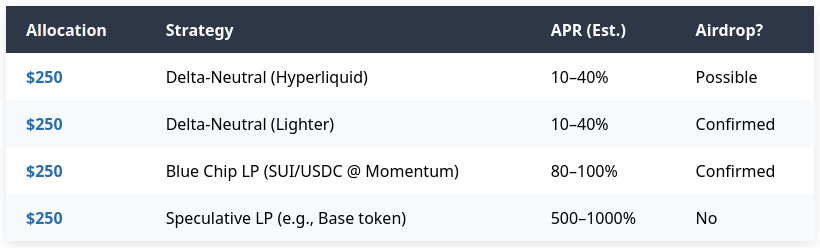

Suggested Portfolio Breakdown

Portfolio Stats:

- 75% of capital in stablecoin pairs

- 25% exposed to token volatility (blue chip + speculative)

- Balanced between current income and future potential

Tips for Success

- Use stop-loss and take-profit to avoid surprises.

- Track APR and adjust positions weekly.

- Don't just chase airdrops — chase value.

- Log everything: deposits, returns, and performance.

Where to Start

Here are some platforms and resources worth checking:

- Hyperliquid — Perpetual DEX, possible airdrop

- Lighter — Perpetual DEX with confirmed airdrop

Keep an eye on whitelisted beta invites, as access may be limited!

Final Thoughts

If you're new to DeFi with limited funds and time, you don't need to gamble to grow. The key lies in combining yield generation with airdrop hunting, all while keeping most of your capital in stable, manageable positions.

In under 3 hours per week, you can:

- Earn double-digit APRs on stablecoins

- Accumulate potential airdrops

- Learn how DeFi really works

Stay disciplined, track everything, and iterate. Remember: DeFi rewards the curious, the early, and the consistent.

What's Your Move?

Would you tweak the allocations? Know another DEX with strong airdrop potential? Drop your thoughts in the comments and let's build smarter together.

source: https://raglup.medium.com/how-to-turn-1-000-and-3-hours-a-week-into-serious-defi-yields-without-gambling-8502e814033f?source=rss-f56f44caad34------2

Wednesday, July 2, 2025

How to Turn $1,000 and 3 Hours a Week into Serious DeFi Yields (Without Gambling)

DeFi is an ocean of opportunities, but also a minefield of risks. If you're entering this space with only $1,000 and limited time, the worst thing you can do is gamble it all on speculative tokens. Instead, what you need is a deliberate, strategic approach that maximizes learning, minimizes exposure, and sets you up for long-term success.

This article outlines a practical DeFi plan tailored to those with small capital and tight schedules. You'll discover low-risk strategies, smart airdrop farming, effective liquidity provision, and how to earn passive income with minimal active management — all while building exposure to future opportunities.

Step 1: Start Slow — Your First Rule

If $1,000 is all you can allocate, then it's precious. Don't rush. The first priority is to learn how DeFi works using small amounts — think $10 or $20 — before committing real capital.

Key points:

- Spend time testing wallets, bridges, swaps, and networks.

- Track protocols that offer airdrop points for usage.

- Join community Discords, follow dev teams, and read whitepapers.

"Speed is irrelevant if you're going in the wrong direction."

Step 2: Explore the DeFi Toolbox

Here are the core strategies available in DeFi today:

Lending Platforms (Low Risk)

- Supply stablecoins and earn interest.

- Optional: Borrow against your collateral and re-deposit (looping).

Delta-Neutral Strategies (Medium Risk)

- Long and short the same asset across two platforms.

- Capture funding rate spreads while avoiding market exposure.

Semi-Delta Neutral (Medium-High Risk)

- Slight market exposure with added rewards potential.

Liquidity Pools (Variable Risk)

- Provide tokens to trading pools and earn fees.

- Use full-range LPs (passive) or concentrated LPs (active).

Strategy Spectrum by Risk/Time:

Step 3: Delta-Neutral Yield + Airdrop Farming

Earn APR now + a potential future airdrop — the holy grail of DeFi.

Open mirrored positions across two perpetual DEXes:

- SHORT on one DEX (e.g., Hyperliquid)

- LONG on another DEX (e.g., Lighter)

Example:

- Asset: SUI

- Hyperliquid: SHORT, earning 10.95% APR

- Lighter: LONG, earning -32% APR (you get paid)

Both positions should be set with:

- Matching amounts (e.g., $250 each)

- Matching Stop Loss and Take Profit (inverted)

Bonus:

You earn points on Lighter (confirmed airdrop) and potentially on Hyperliquid (based on past behavior).

Pro tip: Maintain positions open longer to maximize airdrop points. It's not just about volume.

Time commitment: ~10–15 minutes/day

Step 4: Add Liquidity to Blue Chip Pools with Airdrop Potential

Use concentrated liquidity (Uniswap V3-style) on promising DEXs:

- Example: Momentum DEX on SUI network

- Pool: SUI/USDC

- APR: Up to 100%

- Multiplier: x2 points for upcoming airdrop

Why this works:

- SUI is a top-15 token ("blue chip")

- Less volatility than meme coins

- Good APR + future airdrop potential

State Diagram — Risk & Reward

Step 5: Optional High-Risk High-Reward LP

Allocate the last $250 to a low-cap token LP on a growing L2 (e.g., Base):

- Project: Real utility (not meme)

- APR: Up to 1,000%

- Token: Small cap (~$5M market cap)

This is NOT for everyone.

Expect volatility, impermanent loss, and wild swings. But if chosen wisely, these LPs can deliver outsized short-term returns.

Suggested Portfolio Breakdown

Portfolio Stats:

- 75% of capital in stablecoin pairs

- 25% exposed to token volatility (blue chip + speculative)

- Balanced between current income and future potential

Tips for Success

- Use stop-loss and take-profit to avoid surprises.

- Track APR and adjust positions weekly.

- Don't just chase airdrops — chase value.

- Log everything: deposits, returns, and performance.

Where to Start

Here are some platforms and resources worth checking:

- Hyperliquid — Perpetual DEX, possible airdrop

- Lighter — Perpetual DEX with confirmed airdrop

Keep an eye on whitelisted beta invites, as access may be limited!

Final Thoughts

If you're new to DeFi with limited funds and time, you don't need to gamble to grow. The key lies in combining yield generation with airdrop hunting, all while keeping most of your capital in stable, manageable positions.

In under 3 hours per week, you can:

- Earn double-digit APRs on stablecoins

- Accumulate potential airdrops

- Learn how DeFi really works

Stay disciplined, track everything, and iterate. Remember: DeFi rewards the curious, the early, and the consistent.

What's Your Move?

Would you tweak the allocations? Know another DEX with strong airdrop potential? Drop your thoughts in the comments and let's build smarter together.

source: https://raglup.medium.com/how-to-turn-1-000-and-3-hours-a-week-into-serious-defi-yields-without-gambling-8502e814033f?source=rss-f56f44caad34------2

Wednesday, June 11, 2025

PM Certification FastTrack VIP

| View this email as Webpage |

|

To be removed from this list please visit manage subscription to unsubscribe. Media LLC |